Bitcoin vs. Bitcash – Everything You Need to Know

The boom of cryptocurrency spread like wildfire not long ago. Thousands of people began investing in Bitcoin, and other forms of digital currency like Bitcash, Ripple, and Etherium started popping up. Even though cryptocurrencies are becoming more and more commonplace, what do you really know about them?

Bitcoin vs. Bitcash – Everything You Need to Know

In our guide, we will talk you through the history of digital currency, how they work, and what are the advantages and disadvantages of using different types of currency like Bitcash against the original Bitcoin. If you want a brief overview of the world of cryptocurrency, make yourself comfortable for a quick read.

Bitcoin vs. Bitcoin Cash – The Details

Want to know everything about cryptocurrency? Can’t figure out the difference between Bitcoin and Bitcoin Cash? Well then, this guide is for you. Here’s everything you need to know.

What is Cryptocurrency?

The easiest way to describe cryptos is that they are a form of digital cash.

The easiest way to describe cryptos is that they are a form of digital cash.

Just like real-life money, they have value, except that they are not bound by a physical form, nor a central authority that controls or manages them.

Developers from all over the world have established cryptocurrencies and an active community that maintained and improved them through blockchain technology (which will be discussed further.)

Before we delve into the workings of cryptocurrencies, its best to know why they were created in the first place.

What Caused The Emergence Of Cryptocurrencies?

Cryptocurrencies came into the fold a decade ago, and it was developed to combat the financial crisis created by the traditional banking system. Many experts have likened this period to the Great Depression. Yes, it was that bad.

U.S. banks began handing out loans left and right to gain more customers, but this decision caused their downfall. Many people weren’t able to pay them back, and after a while, the low influx of money caused the banks to collapse and file for bankruptcy.

Many people lost a lot of their money, while the influence and power of banks began to wane because of this disaster. This inspired a team of talented individuals to form a different kind of financial asset that was more secure.

Bitcoin Is Born

BTC was the first-ever successful form of cryptocurrency. Contrary to popular belief, there were other formed concepts of digital cash before Bitcoin’s conception, but none were as popular or as effective.

Bitcoin aimed to prevent any issues that would arise from the mismanagement of conventional money by introducing several useful features:

- Privacy And Anonymity

- Affordable Transaction Fees

- Decentralization

- Faster Transactions Abroad

- Finite Supply = Less Financial Problems Like Inflation

Many other advantages come with using cryptocurrencies, but these are the most important ones.

Blockchain Technology

Every cryptocurrency uses a technology called blockchain, which, as you may have guessed, consists of a “chain of blocks.” The blocks are a form of records grouped together. They move on to the next block as soon as the maximum memory is reached on the previous block.

You can imagine them as boxes filled with data showing every successful crypto transaction and their details. Every block comes with a timestamp showing its time of creation and process.

A blockchain is basically a decentralized form of a ledger that spans thousands of servers, and every person within the network has a separate copy of the blockchain. Blocks have to be extensively processed to become a part of the chain. And this serves as the timeline for every past transaction.

Forks

What about Bitcoin Cash? Does it use the same blockchain as Bitcoin? The short answer is yes. It does so through the use of forks, where the original blockchain code is only updated on specific nodes.

The original stays the same, while these updated nodes separate from the original to form new blockchains. The formed-coins of these new blockchains are different and separate from the original.

You may be wondering why these new cryptocurrencies were created in the first place. Well, Bitcoin isn’t exactly a perfect system, and a portion of its community wanted something better.

The Forming Of Bitcoin Cash

Bitcoin Cash or BCH was formed on August 1, 2017, after members of the Bitcoin community were dissatisfied with the original protocol.

After a series of debates, they decided to create a whole new cryptocurrency that has a block limit of 8MB, where the original only had 1MB. The bigger block sizes allowed more processed transactions per block, the advantages, and disadvantages of which will be discussed further in.

Fluctuating Prices

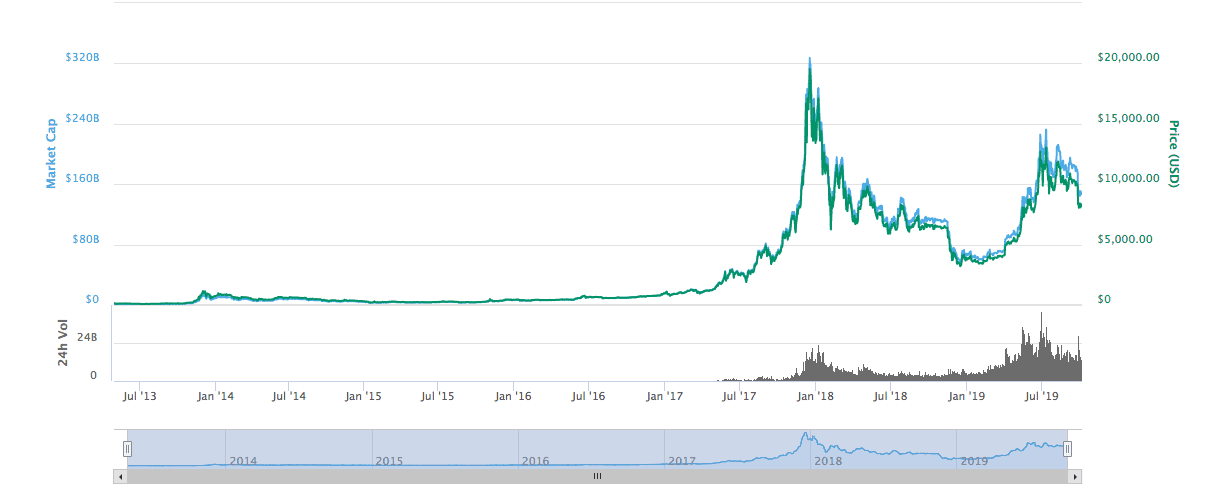

Much like real-life money, the value of cryptocurrencies rises and falls with time. They change depending on how much they are demanded, adopted, and used. We can analyze their value change in relation to their value growth and ROI (return on investment.)

Both Bitcoin and Bit cash hold a particular value. Bitcoin, being the oldest and most established form of cryptocurrency, holds the most value and dominates a large portion of the crypto market (67.59% as of September 16, 2019), while Bitcash only holds 2.11%.

Bitcoin Cash was created only two years ago. While most assumed that it would capture a large part of Bitcoin’s market share, it’s market dominance has been on a steady decline since its peak on November 13, 2017, at 9.74%.

According to CoinMarketCap, the Bitcoin price is down 0.37% over the last 24-hour trading period, while Bitcoin Cash is up 4.22%. Bitcoin generally has a more stable price fluctuation, as you can see from the chart below.

Need Help?

Many available sites give up-to-date crypto-market information like CoinMarketCap, TradingView, and CryptoCompare if you want to follow the cryptocurrency trends yourself.

The crypto market is becoming more and more congested, with new forms of cryptocurrency trying to climb the ranks. But Bitcoin reigns supreme as the top currency, with Bitcoin Cash following suit in 4th place. Does this mean that Bitcoin is the best form of cryptocurrency? Not necessarily.

BCH vs. BTC: The Pros And Cons

Now you have a slight idea about what both are. What do you say we take a look at the advantages and disadvantages of each one? Alright then. Let’s go.

Bitcoin Cash

We’re going to kick it off with the newcomer. There you go:

- Advantages

This one is much cheaper than Bitcoin, so it is easier to get a hold of. Its transaction fees are also lower. Presently, it has an average transaction fee of $0.00396, while Bitcoin’s is $1.045. Bitcoin’s average transaction fee suffers from high spikes (with the worst being $63.85 on December 22, 2017). On the other hand, Bitcoin Cash’s has been consistently on the lower side since its conception:

Being cheaper and faster makes Bitcoin Cash more commerce-friendly in general.

- Disadvantages

While an increased block size offers benefits, it has a possible side effect of reducing the resistance of the network to outside attacks as well as centralization.

It also has lower investor confidence compared to Bitcoin, and its “market penetration and adoption rate” is less dominant. This stems from the fact that it is much new to the cryptocurrency market than Bitcoin.

Trading is less viable in terms of available trading pairs — the cumulative effects of these disadvantages lower the price and adoption rate of Bitcoin Cash.

Bitcoin

Now for the giant in the industry. Here are the merits and demerits of Bitcoin.

- Advantages

Being the original source, Bitcoin acts as the base currency for the whole cryptocurrency system. This is what the rest of the cryptocurrencies are trading against and is tradable on practically every exchange (It has the most trading pairs.)

It dominates more than half of the entire crypto market (67.6%) and remains the Gold standard in a rapidly expanding and very competitive industry. Because of its massive user base and higher market cap, Bitcoin retains its value much better than Bitcoin Cash.

Having the most full nodes in the crypto market, it makes it incredibly difficult to get attacked by centralized institutions and governments.

- Disadvantages

Bitcoin is much more expensive and has higher transaction rates. Transactions are also usually slower. This makes it a terrible choice for general purchases.

Another minor disadvantage is that Bitcoin’s development team doesn’t have a stronger united front compared to other teams. This inner discourse, coupled with its massive user base, might end up hindering its improvement process.

Investing With Cryptocurrency

It’s quite easy to say that different people have an interest in buying cryptocurrency. Everyone has their reasons. Whether it’s for anonymity or just to make a profit, investing in Bitcoin, Bitcash, or any kind of cryptocurrency can be a good idea. Let’s talk about some “wheres and hows.”

1. Where Do I Buy Them?

Don’t know your way around? I’ll help you with that. Lets first kick it off with where you can buy cryptocurrency.

Cryptocurrency Exchanges

These establishments often come with a charge for handling the transaction, so be sure to do your research and find one that suits you. These two are the more popular ones:

- Coinbase

This is very popular among U.S. based cryptocurrency investors because linking your bank account relatively easy. Coinbase charges a 0.5% spread of the purchase and an additional fee that depends on which region you’re in and the type of payment you used.

- Binance

Considered the biggest cryptocurrency exchange in the world by volume, Binance charges a withdrawal fee and an additional 0.1% fee for every trade. There are discounts available, so be sure to check for them. In Binance, cryptocurrencies are usually exchanged for each other. However, you do have to option of buying them with a credit card for a price.

Broker Exchanges

People often employ brokers for the benefits of having greater liquidity pools, lower slippage and spread fees, and more tradable cryptocurrency pairs. Here are two of the best crypto brokers:

- Plus500

Plus500 offers many benefits such as numerous payment options (like Paypal,) $100 minimum deposits, a live chat option, and a quick sign-up process.

- eToro

eToro offers many payment options, a minimum deposit of $200, and an excellent support team.

Other Ways You Can Invest In BTC

Want more? You got it. Check the following.

- Bitcoin ATM

It works just like ATMS for physical cash. Coin ATM Radar has thousands of ATMs across the U.S.

- P2P Exchanges

Users can post advertisements stating their desired exchange rate and method of payment for Bitcoins. Other users can answer the advertisements with the option of meeting in person and paying with cash or using online banking to trade directly.

- Grayscale Funds

You can get both Bitcoin and Bitcoin Cash through grayscale, an asset manager for your digital currency. While these shares cost more than the actual value of the coin, you don’t have to worry about storage or implementing additional security.

A Few Tips Before Locking In Your Purchase

Before you make any decision, I highly recommend you take a look at the following tips. I’m quite sure you’ll have a different perspective on the matter:

- Have your basic information in hand

Your SSS, bank account number, ID picture, passwords to your digital wallet, etc. Crypto transaction and registration processes require your data, so it’s best to be prepared.

- Avoid using a credit card

Funding your investments by borrowing from high-interest sources is a bad idea.

- Be aware that crypto investments have no insurance

The Securities Investor Protection Corporation does not insure Cryptocurrency in the case of theft or failure (A few exchanges such as Coinbase have their own insurance policy, though.)

- Make sure that online transactions are done with a secure and private internet connection. (Try a credible VPN).

- If the exchange platform you want does not offer your preferred cryptocurrency, you can simply buy Bitcoin first and exchange it for your preferred currency.

2. How Do I Store My Cryptocurrency?

You can keep your currencies in two types of digital wallet:

Hot wallet

Established providers or exchanges offer this kind of wallet through cloud storage that can be accessed through the internet. Exchanges offer hot wallets upon joining. Many prefer to use third-party hot wallets that can be used across different platforms.

Transactions are usually faster for hot wallets. But be aware that hot wallets with Bitcoin have a high risk of being hacked. Be sure to choose an exchange platform that offers insurance, or at least extra security.

Here are a few popular sources for hot wallets:

- Blockchain

It doesn’t come from currency exchange, reducing your risk of being a hacking target.

- Coinbase

It comes with insurance that covers losses caused by hacks, theft, false transfers, and security breaches.

- Electrum

Unique software that lets you store your currency on your computer.

- Mycelium

A mobile hot wallet for both iOS and Android users.

Cold wallet

Cold wallets provide extra security measures that hot wallets don’t have. They come in the form of portable devices that can store your currency. Here are some popular cold wallet providers:

-

- Ledger Nano: Similar to a flash drive, these wallets can cost $60-$120

- Trezor: Very tiny cold wallets that cost $80-$170

Remember to use strong passwords as well as two-factor authentication for your currency exchange digital wallet accounts.

3. How Do I Manage My Investment?

Remember that every investment comes with potential risks. Digital currencies are subject to relatively higher risks because they are much newer to the game compared to other established forms of investments like bonds or stocks. Here are a few ways you can reduce those risks:

- Diversify Your Portfolio

You’ve probably heard of this before, many investors have used this tactic way before the birth of cryptocurrencies. By investing in numerous sources, you have a higher chance of maintaining your investments where lucrative currencies can make-up for failed ones.

- Play the “Buy and Hold” Game

It’s as simple as it sounds. Buy some cryptocurrency and just wait for its value to rise. This is considered a passive form of investment that often outperforms its active counterpart. It’s also less expensive because of lower transaction fees.

As mentioned in the previous parts, the market for digital currency is extremely volatile, with prices constantly in a state of flux. These few key strategies we have mentioned can help you manage your investment in a volatile market.

Granted, it may not be the quickest way of earning from your investments for the short term, but it generally performs better in the long run. This is great for beginners who want to dip into the world of cryptocurrencies.

Bitcoin vs. Bitcash – Conclusion

There is plenty to learn about the workings of cryptocurrencies like how to acquire them, or the risks associated with them. But we hope that our guide has given you some understanding of what cryptocurrencies are, how they work, and how to invest with them safely.

If there’s anything that you can’t wrap your head around, give us a shout out in the comments below and we’ll shed some light on the matter.

Hi, all is going nicely here and ofcourse every one is sharing data, that’s actually excellent, keep up writing.